A 2025 Review on the Dutch Energy Market

2025 has brought big shifts to the Dutch energy market. To name a few - Allocation 2.0 Tranche 3, new reconciliation rules, tighter trading intervals, and advanced balancing systems. The increased precision in settlement and energy management is making the market more responsive to real-time supply and demand, especially with the deeper integration of renewable resources and flexible assets.

We will cover all of these in this 2025 Dutch energy market year-in-review.

1. Allocation 2.0 Tranche 3 – the Introduction of SMA and TMT Reconciliation

The biggest change came at the start of the year – the Allocation 2.0 Tranche 3 market change went live on the 1st January 2025, with the first provisional messages being received in March 2025.

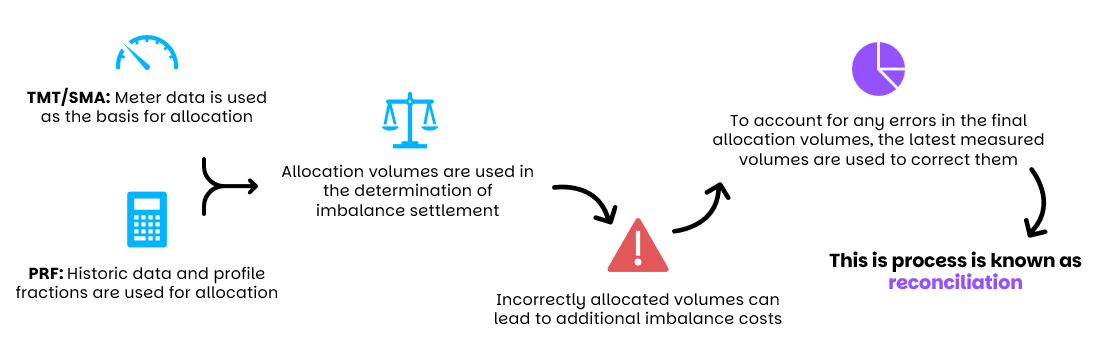

Primarily, Tranche 3 introduced new reconciliation processes for telemetric (TMT) and smart meter (SMA) allocated connections, as well as updated settlement prices. The principle behind reconciliation is that if there were errors in the allocated volumes, these would propagate forwards into the imbalance calculation, resulting in the Balance Responsible Party (BRP) being incorrectly billed:

With the advent of Tranche 3, measurement errors and volume discrepancies for SMA and TMT allocated connections are now corrected through newly introduced reconciliation processes for BRPs. Notably, Tranche 3 also marked the first time that suppliers were required to interface with TenneT’s market-2-market communication hub (MMC-Hub), in order to receive the final monthly volumes used in the reconciliation process.

Here at Eneve, we provided a full solution for the retrieval of the new TMT/SMA reconciliation messages and storage of the data (volumes and prices), with overviews of completeness and volume cross-checks ensuring that our clients remain in control of their reconciliation data.

2. Balance Delta Publication Adjustments

On the balancing side of things, TenneT has been tinkering with the balance delta publication; this represents how much balancing power is being requested by TenneT, and is provided to market parties once per minute. In theory, this allows market parties to engage in ‘passive’ balancing, acting in the opposite direction of market imbalance to avoid unfavourable imbalance costs. The balance delta is published by TenneT here.

In practice, the Netherlands has been experiencing large and rapid fluctuations in power as market players respond to the balance delta, resulting in a large number of quarters with regulation state 2. In December 2024, TenneT increased the delay of the balance delta publication from 3 minutes to 5 minutes, hoping that market participants would respond less strongly to it - thereby resulting in fewer oscillations. Additionally, in order to limit power oscillations, TenneT requested that the ramprate of assets be contained to 20% of the Pmax of the installation when participating in passive balancing, and that the ramp direction not be changed more frequently than once every 15 minutes.

Unfortunately, the 5-minute delay of the balance delta did not have the effect that TenneT had hoped for. Consequently, they rolled back the balance delta publication delay to 2 minutes as of 1st July 2025. Further adjustments and optimizations to the balance delta publication can be expected in the near future.

3. Transition to 15-minute Market Time Unit (MTU) for the Day-Ahead Market

On the 30th September 2025, the European Day-Ahead Market (accessible through EPEX SPOT and Nordpool trading platforms) transitioned from hourly trading blocks to 15-minute trading blocks. This has a number of benefits:

- Allows for more precise alignment between electricity supply and demand

- Previously, the Intraday market was the only market with the 15-minute MTU, meaning that market parties would have to wait until the intraday phase before matching supply and demand per quarter

- This is especially relevant because the imbalance settlement period (ISP) is also 15 minutes – the alignment of the day-ahead market with the imbalance market should help reduce imbalance costs

- Improves the integration of renewable energy sources such as wind and solar, which favour 15-minute blocks over hourly blocks due to their often volatile nature

- Supports dynamic tariff models, which are often based on day-ahead prices – there will now be a day-ahead electricity price per 15-minutes, rather than only per hour

A few of our EBASE Supply customers have already transitioned to this new interval; some of their end-users are now going to be invoiced on 15-minute day-ahead intervals, depending on their contract. For others, this will start next year in 2026, when contracts are renewed.

4. Updates to automatic Frequency Restoration Reserves (aFRR)

The aFRR balancing product saw a few adjustments over the last year:

TenneT on PICASSO: In October 2024, TenneT joined the PICASSO platform, which is the European platform for exchanging balancing energy of aFRR – this allows participating TSOs to activate aFRR in the TSO area where aFRR bids are the cheapest. While this had no IT impact for market parties, it did impact the balancing energy and imbalance price in the Netherlands because of activation based on the European balancing situation.

Decimal Setpoints: From July 2025, aFRR requested activation volumes (known as ‘delta setpoints’) can now be sent in decimal increments (minimum 0.1 MW) rather than integers (minimum 1 MW) – this allows TenneT to change setpoints more gradually, and makes bids more flexible in their activation and deactivation (especially for smaller bids < 4 MW).

4-hour Capacity Auctions: On 11th November 2025, TenneT will introduce 4-hour capacity auctions for aFRR. In addition to the capacity auctions for the whole day, six 4-hour auctions have been added. This better enables the use of storage and renewables in the aFRR process, which would otherwise struggle to meet a 24-hour capacity availability obligation. While the 24-hour auction block will initially be maintained, there is a view to completely replace 24-hour auctions with 4-hour auctions within the next year.

In the last months of 2025, Dutch energy market participants face both opportunities and challenges created by new reconciliation processes, more frequent trading intervals, and evolving balancing obligations.

The increased precision in settlement and energy management is making the market more responsive to real-time supply and demand, especially with the deeper integration of renewable resources and flexible assets.

Eneve’s commitment to providing robust data retrieval, monitoring solutions, and client support ensures that stakeholders remain ahead of regulatory change, making the most of the dynamic, complex energy landscape.

Related articles

14-11-2025

Looking into the Dutch Energy Market in 2026 - What's in the Horizon?

The Dutch energy market is heading into a period of major transformation in 2026; which is mostly driven by both European integration efforts and ...

10-11-2025

A 2025 Review on the Dutch Energy Market

2025 has brought big shifts to the Dutch energy market. To name a few - Allocation 2.0 Tranche 3, new reconciliation rules, tighter trading ...

05-09-2024

The Power Market Welcomes Standardization

Energy21 is now part of Eneve. The technologies and solutions mentioned in this article are now integrated into Eneve’s portfolio.